Anticariat online

Librărie cu mii de cărți noi și vechi din toate domeniile, colecțiile și categoriile, cu stoc actualizat zilnic și promoții săptămânale.

Fiecare comandă îți poate aduce reduceri supriză!

Noutăți în stoc

-

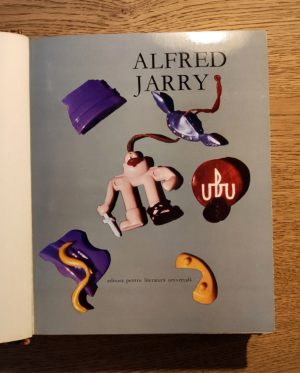

Ediții princeps, Teatru și dramaturgie

de Alfred Jarry149,00 leiPrețul inițial a fost: 149,00 lei.94,00 leiPrețul curent este: 94,00 lei. Adaugă în coș -

de Eugen Ionescu

270,00 leiPrețul inițial a fost: 270,00 lei.249,00 leiPrețul curent este: 249,00 lei. Adaugă în coș -

Cărți pentru copii, Religie și spiritualitate

64,00 leiPrețul inițial a fost: 64,00 lei.49,00 leiPrețul curent este: 49,00 lei. Adaugă în coș -

de Marius Porumb

99,00 leiPrețul inițial a fost: 99,00 lei.84,00 leiPrețul curent este: 84,00 lei. Adaugă în coș

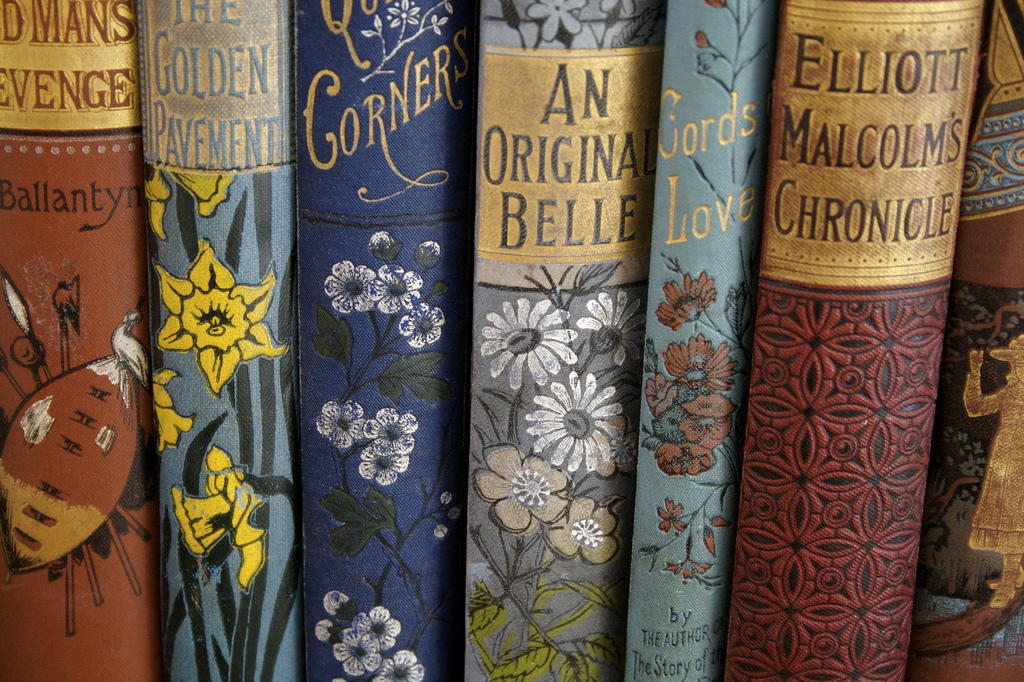

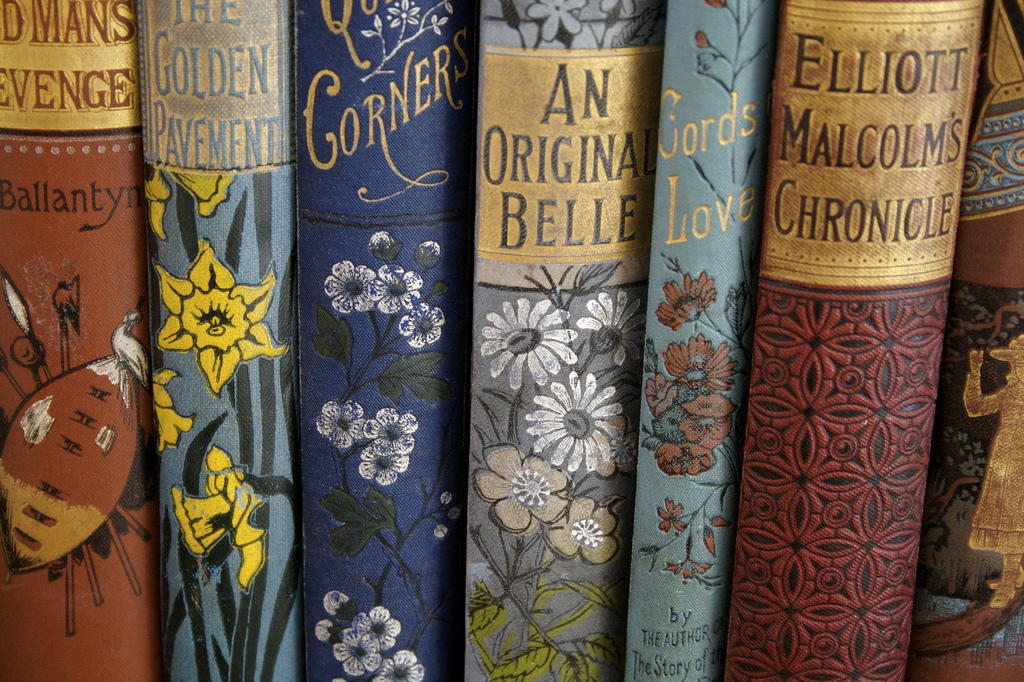

Cărți noi și vechi din toate domeniile

Anticariatul Cărți Online vă așteaptă cu o ofertă bogată de cărți noi și vechi – dar în stare foarte bună – din toate domeniile disponibile. Cărți scrise de autori români și străini, de la romane clasice la cărți de specialitate, cu un stoc în continuă creștere.

Cărțile sunt ambalate atent și sigur, în înveliș de protecție, pentru a ajunge în biblioteca dvs. în cele mai bune condiții. Fotografiile prezentate în dreptul cărților din anticariat sunt actuale și sunt poze reale ale cărților respective, deși uneori este posibil ca exemplarele aflate în stoc să se schimbe. Multe din titlurile anticariatului au și imagini cu detalii din interiorul paginilor, pentru o mai bună ilustrare generală a cărții.

Librăria Cărți Online.

Despre anticariatul Cărți-Online

Anticariat online și librărie cărți online vechi și noi ce oferă o bogată gamă de carti anticariat și de librărie, cu mii de titluri din toate domeniile, de la beletristică și romane de dragoste, la volume de istorie, artă și filosofie, cărți pentru copii și ediții princeps.

Noutăți zilnice

Actualizăm zilnic stocul cu titluri noi din majoritatea domeniilor disponibile. De obicei avem un singur exemplar disponibil din fiecare, așa că urmăriți-ne cu atenție.

Suport clienți

Fie că sunteți în căutarea unei cărți sau doriți informații despre comanda dvs., suntem disponibili pentru a vă răspunde la întrebări, telefonic sau prin email.

Comandă securizată

Comandați cu încredere! Toate comenzile sunt securizate și criptate cu certificat de securitate SSL de 128-bit pentru a garanta confidențialitatea datelor dvs.

Ofertele săptămânii!

Descoperă cele mai recente oferte de carte și pachete promoționale în catalogul anticariatului nostru.

Cele mai căutate cărți din anticariat

-

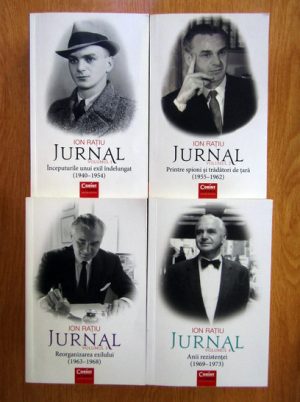

Autori români, Jurnale, memorii, biografii

de Floriana Jucan74,00 leiPrețul inițial a fost: 74,00 lei.64,00 leiPrețul curent este: 64,00 lei. Adaugă în coș -

de Alan H. Cohen

56,00 leiPrețul inițial a fost: 56,00 lei.39,00 leiPrețul curent este: 39,00 lei. Adaugă în coș -

de Aurel Popescu-Balcesti

39,00 leiPrețul inițial a fost: 39,00 lei.36,00 leiPrețul curent este: 36,00 lei. Adaugă în coș -

de Mihail Solohov

129,00 leiPrețul inițial a fost: 129,00 lei.64,00 leiPrețul curent este: 64,00 lei. Citește mai mult -

de Marie Anne Desmarest

159,00 leiPrețul inițial a fost: 159,00 lei.84,00 leiPrețul curent este: 84,00 lei. Adaugă în coș -

de Sigrid Undset

74,00 leiPrețul inițial a fost: 74,00 lei.64,00 leiPrețul curent este: 64,00 lei. Citește mai mult -

Cărți pentru copii, Religie și spiritualitate

64,00 leiPrețul inițial a fost: 64,00 lei.49,00 leiPrețul curent este: 49,00 lei. Adaugă în coș -

de Ion Mihai Pacepa

36,00 leiPrețul inițial a fost: 36,00 lei.32,00 leiPrețul curent este: 32,00 lei. Citește mai mult -

de S.N. Sergheev Tenski

174,00 leiPrețul inițial a fost: 174,00 lei.149,00 leiPrețul curent este: 149,00 lei. Citește mai mult -

de Edward Gibbon

49,00 leiPrețul inițial a fost: 49,00 lei.39,00 leiPrețul curent este: 39,00 lei. Adaugă în coș -

de Lasse Braun

64,00 leiPrețul inițial a fost: 64,00 lei.59,00 leiPrețul curent este: 59,00 lei. Citește mai mult -

de A. Stepanov

84,00 leiPrețul inițial a fost: 84,00 lei.49,00 leiPrețul curent este: 49,00 lei. Citește mai mult

Edituri

Este puțin probabil să fi existat o editură în România din 1945 încoace și să nu avem în catalogul anticariatului măcar un titlu publicat. Iar în cazul unora din ele, avem chiar toate volumele tipărite de acestea. Iată șase din cele mai reprezentative edituri din anticariat: